I read “Blink” by Malcolm Gladwell and it describes how a Chicago attorney, Ian Ayres, did an experiment on racism and auto selling. Participants (18 white men, 7 white women, 8 black women, and 5 black men) were trained to go into car dealerships in Chicago and negotiate in a standard way for a car purchase. Results showed that without saying a word, Ayres’s black men were offered a price nearly $800 higher than Ayres’s white men.

Furthermore, poor people are more likely to pay more for their car loan and more for their auto insurance based on where they live. As a result, people of color paid an average of $2,662.56 more over the life of their car loan than their less qualified white peers.

- Food Access: Very often, big supermarket stores have gimmicks to card holders that save buyers money. Often the lower classes don’t have access to large chain supermarkets, so they end up paying more for food than their wealthier counterparts. There are half as many supermarkets in poorer areas than wealthier areas.

- Education: Another way the lower classes lose is the lottery. In some states, children with good grades regardless of financial need, can go to college with funds generated by the lottery. Those with less money are more likely to play the lottery than the middle class or wealthy. Poor people are subsidizing middle class families through these programs.

- Financial firms are discriminating against people based on where they go to college. A watchdog group found that certain lenders are charging higher interest rates on student loans to graduates of historically black or predominantly Hispanic colleges.

- Transportation: A lot of people struggling on low income don’t have EZ pass so they pay $15.00 for some tolls while people with EZ pass pay in the area of $10.00. And tolls are just the tip of the problem. Households in poverty spend a higher proportion of their income on transportation expenses and are disproportionately represented by race/ethnicity (Blacks and Hispanics). Limited used vehicle availability, higher insurance rates, and fewer affordable transportation options make transportation expenses disproportionately high for low income individuals. Businesses feel they can take advantage of the African American community.

To make matters worse…

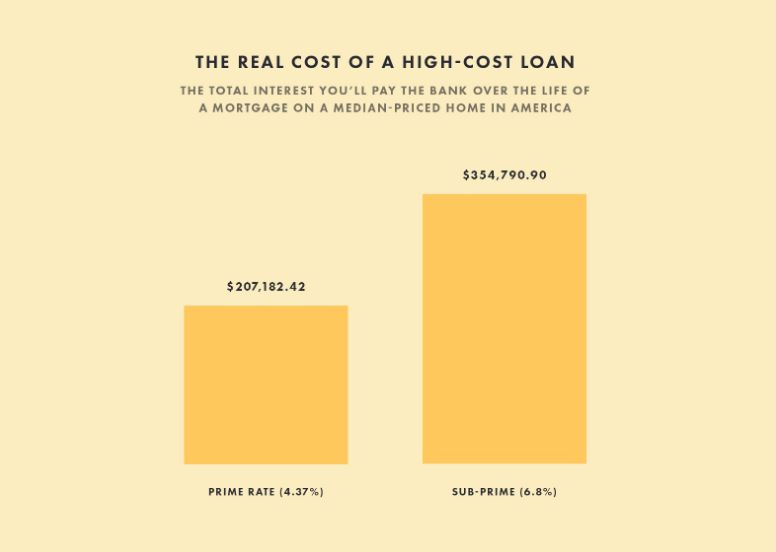

- Banking: Research has found that African Americans are 105% more likely, and Latinos 78% more likely, than whites to have a high-cost home loan. Do you think this makes a big difference? Look at the difference in cost of home based on the different interest rate!

- Credit Card Debt: When people get desperate, they go to lenders that take even worse advantage of them. Many working-class and middle-class families get caught up in credit card debt. Interest rates in the high teens and low twenties make interest expenses costly.

- Pay Day Loans: What most people in their income area do not know about are pay day loans. Pay day loans, common in areas with high concentrations of poverty, are a way people can get a small loan, typically under $500, lent at a VERY high interest rate, that must be paid off at the time of their paycheck arriving. These high intertest rates, as much as 667% per year, as well as other fees associated with the practice, cost these low-income workers an astronomical amount of money.

Every poor person knows these facts to be true. This knowledge adds to people’s frustration when told that they need to work harder and pull themselves up by their bootstraps. It is not an equal playing field and the economic deck is clearly stacked against people of color.

What can be done to the tax code to help?

- Make households with high incomes pay a larger share of their income in state and local taxes than households with lower incomes — the opposite of the upside-down tax systems in place in 9 of every 10 states today. Most states’ tax structures are regressive and worsen racial and ethnic inequities; households of color are more likely to have lower incomes and less wealth than white households. An example of a regressive tax is the sales tax. Everybody needs a certain amount of basics (i.e. gas, food, medicines) to live. There is also “luxury” or “sin tax” items such as cigarettes and alcohol that are also heavily taxed. Tariffs increase the cost of goods for everybody. What happens with a regressive tax system is that people with less money pay a much higher percentage of their income to necessities

- States can take steps such as strengthening their income taxes and otherwise improving the structures of their tax systems, better taxing wealth, enacting or expanding tax credits for low-income families, and eliminating various fees used to raise resources for the courts, and other parts of the justice system, that can trap low-income individuals (often people of color) within cycles of debt and criminal justice involvement.

- Investigate and levy heavy fines on business (especially banks) on those that actively discriminate or engage in any unfair business practices against low income consumers or people of color.

Small changes could make a big difference to a lot of people; people who need it the most.

Some excellent points Barry. The predatory practices of most credit providers is despicable.